Have you ever wondered if there’s money waiting for you that you didn’t even know about? If you’ve ever moved, closed an old bank account, or had a family member pass away, there’s a chance that unclaimed money is out there with your name on it. It’s time to take action and find out if you qualify for these funds!

What Is Unclaimed Money?

Unclaimed money refers to funds that have been abandoned or forgotten. This can include bank accounts, insurance policies, rental deposits, and even forgotten tax refunds. When these funds go unclaimed for a certain period—often due to a lack of communication from the owner—states and organizations are required to report them to government agencies. These agencies hold the money until the rightful owner comes forward to claim it.

Why You Should Check for Unclaimed Funds

Many people are surprised to learn just how common unclaimed money is. In the U.S. alone, billions of dollars are sitting in state treasuries waiting to be claimed. Each year, millions of individuals discover that they are owed money, often amounts that can significantly impact their financial situation.

Imagine receiving a check for a forgotten savings account or an insurance policy that you thought had lapsed. These funds can be a welcome financial boost, whether you use them to pay off debts, save for a rainy day, or invest in something special.

How to Start Your Search

The process of finding unclaimed money is easier than you might think. Here’s how to get started:

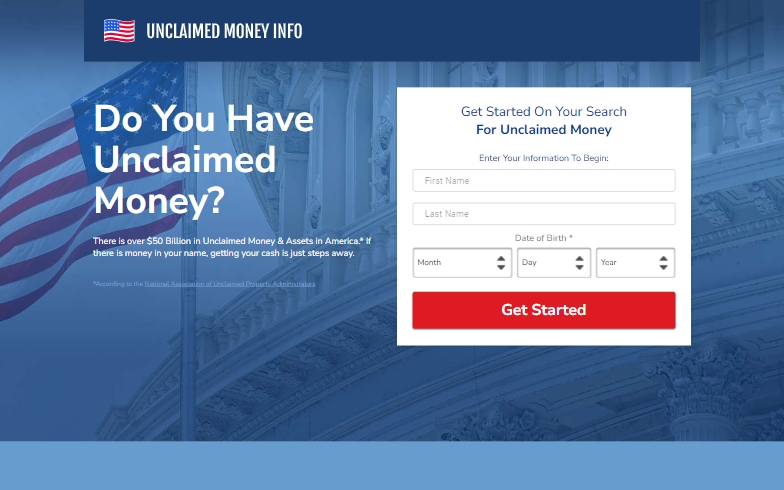

- Visit The Websites: This website has each state unclaimed property division. Start by visiting the website. Look for a section dedicated to unclaimed property, where you can conduct a search using your email.

- Use Trusted Resources: In addition to websites, there are national databases where you can search for unclaimed funds. The National Association of Unclaimed Property Administrators (NAUPA) offers resources that can guide you to your website.

- Gather Information: Have your personal details ready, such as your full name, addresses, and any other relevant information that may help narrow down the search.

- Be Cautious of Scams: While there are many legitimate services that can help you claim unclaimed money, be wary of companies that ask for payment or personal information upfront. Stick to official sources to avoid scams.

- Submit Your Claim: when you find unclaimed money linked to your name, follow the instructions on the website to submit your claim. This may involve filling out a form and providing identification to verify you.

Don’t Wait—Take Action Now!

The longer you wait, the more potential funds could be lost to the state. Don’t let your money sit idle! Take a few moments to search for unclaimed funds that might belong to you. It’s a simple process that could yield unexpected rewards.

Every year, people just like you discover money they didn’t know existed. Why not be one of them? Start your search today, and you might just find some extra cash that could make a difference in your life. Remember, it’s your money—go claim it!

To claim unclaimed money, follow these steps:

- Visit Websites

- You can go to the unclaimed property website.”

- Answer question

- Use your name email and addresses to search the database.

- Gather Necessary Information

- Have your personal details ready, such as your full name, Social Security number, and any other identifying information that may be required.

- Fill Out the Claim Form

- If you find unclaimed money linked to your name, fill out the claim form provided on the site. This may include details about the property and your identification.

- Submit Your Claim

- Follow the instructions to submit your claim. Some states allow you to do this online, while others may require you to mail in your claim form.

- Wait for Processing

- After submission, it may take several weeks to months for your claim to be processed. You can often check the status on the same website.

- Receive Your Funds

- If your claim is approved, you’ll receive your unclaimed funds via check or direct deposit, depending on the state’s policies.

- Check Regularly: New unclaimed funds are added regularly, so it’s worth checking back periodically.

Taking these steps can help you reclaim any unclaimed money that may belong to you. Good luck!